Sustainable Finance 101: Green Bond Principles (GBP) and Green Loan Principles (GLP)

ESG & Sustainability

The background of GBP and GLP

Both green bond and loan have specified that all the use of proceeds (UoP) should be used only for green eligible activities. Compared with a green bond, the size of a green loan is generally smaller and done in a private operation.

The first green bond was issued in 2007 by the European Investment Bank, while there is no public record on the issuance of the first green loan due to its private nature.

Both GBP and GLP are voluntary guidelines in the financial market. GBP was established in 2014 by International Capital Market Association (ICMA). GLP was published in 2018 by Asia Pacific Loan Market Association (APLMA), Loan Market Association (LMA) and Loan Syndications and Trading Association (LSTA). The GLP is built on and referred to as GBP, with the aim of promoting consistency across financial markets.

The four core components

The green bonds and green loans being issued should align with the four core components as set out in the GBP and GLP namely:

Use of Proceeds

All designated eligible Green Projects should 1) provide clear environmental benefits, 2) can be assessed, 3) quantified and 4) reported by the issuer/ borrower.

Both Principles have set out several broad categories of eligible green projects: renewable energy, energy efficiency, pollution prevention and control, environmentally sustainable management of living natural resources and land use, terrestrial and aquatic biodiversity conservation, clean transportation, sustainable water and wastewater management, climate change adaptation, eco-efficient and/or circular economy adapted products, production technologies and processes, green buildings.

Please note that the Principles did not provide specific eligible examples as each project might have its geographical, technical and cultural variations. This is where taxonomy comes in to fill in the gaps. For example, EU taxonomy for sustainable activities is applicable within the European Union; China’s Green Bond Endorsed Project Catalogue and the Green Industry Guiding Catalogue is applicable within China; ASEAN Taxonomy for Sustainable Finance is for ASEAN members.

As more Chinese companies are looking for offshore issuances, the EU-China Common Ground Taxonomy is under development to build a common taxonomy for easier identification and reporting.

Process for Project Evaluation and Selection

The issuer should communicate the following to the investors:

- The environmental objectives

- The process to identify eligible green projects

- The potential social and environmental risk and how to mitigate

Management of Proceeds

The proceeds should be managed under a dedicated account for a proper track record so the allocated and unallocated amounts are clear.

Reporting

Reporting can be divided into allocation reporting and impact reporting.

For allocation reporting, the issuer should include a list of projects that the proceeds have been allocated. The list should include the project description and the respective amount and its environmental benefits.

For impact reporting, the issuer should report the qualitative and quantitative performance indicators which have been set out in the Framework. The metrics might include energy generation and greenhouse gas emissions reduced/avoided.

To conclude, it is the market practice to provide the above details in a Framework document which are readily accessible to the investors. The issuers are also recommended to conduct external reviews which include consultant review, verification, certification and rating to make sure the “green” is truly green and align with international standards.

Appendix

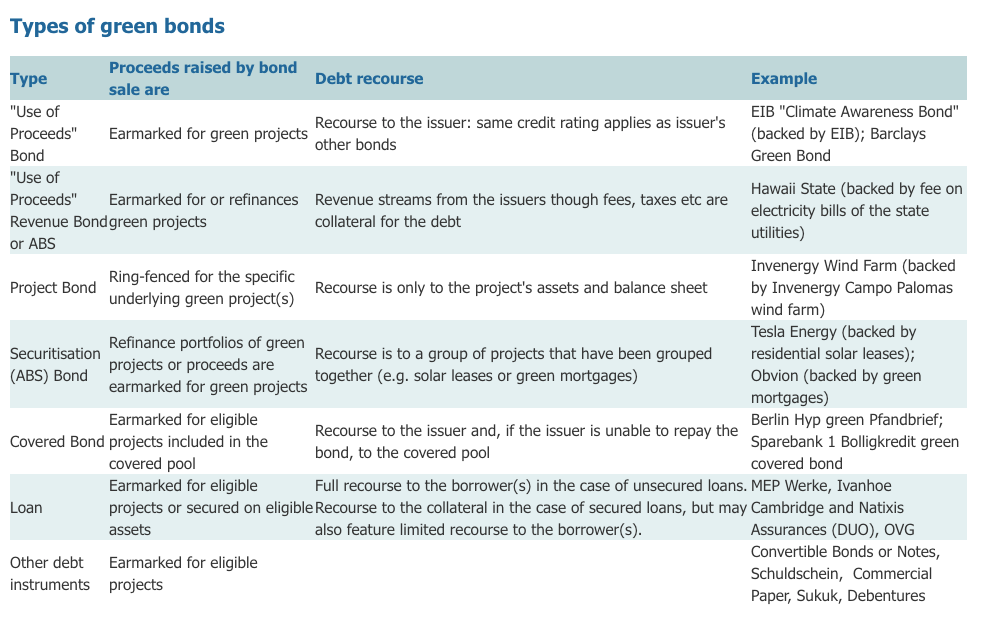

Types of Green Bonds

Explaining green bonds | Climate Bonds Initiative

Climate Bond Initiatives (CBI)

Climate Bond can be viewed as one of the green bond categories. CBI is the world’s first Certification program for climate bonds. They have their own set of principles and certification standards.

Please note that only CBI approved verifiers can provide CBI verification services. The certification process can be found here: Certification under the Climate Bonds Standard | Climate Bonds Initiative

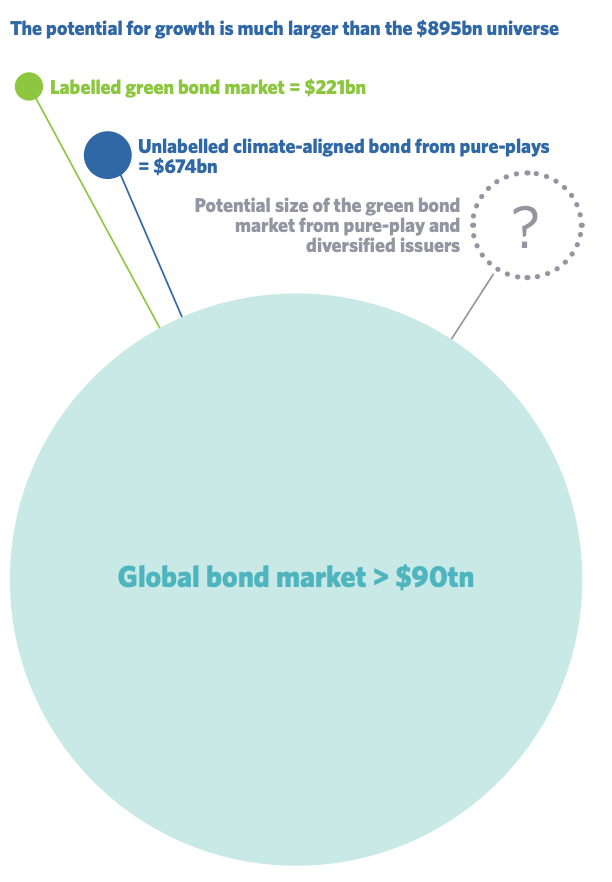

The myth of “Pure Play”

“Pure Play” are generally defined as organizations with more than 90% of revenues are derived from businesses with clear and positive environmental impacts. For example, a company that solely produce solar panels can be considered as a pure-play.

There has been a heated debate in the market on whether pure-play can name their bond/loan as “green” by aligning with GBP/GLP.

For non-pure play companies, the UoP of green bond/loan is for specific project usage, which is also listed out in the GBP and GLP. However, for pure-play companies, the UoP will be applied to >90% of its businesses which can be considered as general corporate usage. Also when it comes to the principles of “additionality”, it seems that the pure-play companies do not derive additional environmental benefits as this is their daily business.

As set out in GBP 2021, for any financing related to pure-play,

“investors will need to be informed accordingly and care should be taken to not imply GBP features by a Green Bond reference. These organisations are encouraged to adopt where possible the relevant best practice of the GBP (e.g. for reporting) for such existing environmental, climate or otherwise themed bonds, and to align future issues with the GBP.”

According to a report from CBI back in 2017, it says

“labelled green bonds are primarily issued by diversified companies whereas the unlabelled portion of the climate-aligned universe is mostly pureplay issuers.”

CBI-SotM_2017-Bonds&ClimateChange.pdf (climatebonds.net)

Other useful resources

- Green Bond Principles The Principles, Guidelines and Handbooks » ICMA — International Capital Market Association (icmagroup.org)

- Green Loan Principles New tab (lma.eu.com)

- Climate Bond Initiatives Climate Bonds Initiative | Mobilizing debt capital markets for climate change solution

- EU Taxonomy for sustainable activities EU taxonomy for sustainable activities | European Commission (europa.eu)

- EU-China Common Ground Taxonomy Common ground taxonomy — Climate change mitigation instruction report (europa.eu)

Comments