Sustainable Finance 101: Social Bond Principles (SBP) and Social Loan Principles (SLP)

ESG & Sustainability

The background of SBP and SLP

Both social bond and loan have specified that all the use of proceeds (UoP) should be used ONLY for social eligible activities.

Compared with green bond and loans with over a decade of history, the social ones is a newly developed category. It is believed that the first social bond was issued by The Spanish Instituto de Credito in 2015.

Both SBP and SLP are voluntary guidelines in the financial market. SBP was published in 2017 by International Capital Market Association (ICMA). SLP was established in 2021 by Asia Pacific Loan Market Association (APLMA), Loan Market Association (LMA) and Loan Syndications and Trading Association (LSTA). The SLP is built on and refer to SBP, with the aim to promoting consistency across financial markets.

The four core components

The SBP and SLP are mostly following the same set of principles as set out in GBP and GLP, which are aligning with the four core components:

Use of Proceeds

All designated eligible social projects should 1) provide clear social benefits, 2) can be assessed, 3) quantified and 4) reported by the issuer/ borrower.

Both Principles have set out several broad categories of eligible social projects: affordable basic infrastructure, access to essential services, affordable housing, employment generation, and programs designed to prevent and/or alleviate unemployment stemming from socioeconomic crises, food security and sustainable food systems, socioeconomic advancement and empowerment.

The issuer should also state clearly the target populations which can benefit from the social projects. Examples include those living below the poverty line, excluded and/or marginalised populations and/or communities, people with disabilities, migrants, undereducated, underserved, unemployed, women, gender minorities, ageing populations, vulnerable youth, groups that suffered from natural disasters.

In Jun 2021, European Union is drafting the Social Taxonomy with the purpose to establish a clear global standard for what “good” looks like on social issues. As compared with green UoP, the social UoP shed more light on the geographical and cultural differences. What is considered “social” in Area A might not be recognized as “social” in Area B.

Process for Project Evaluation and Selection

The issuer should communicate the following to the investors:

- The social objectives

- The process to identify eligible social projects and their target populations

- The potential social and environmental risk and how to mitigate

Management of Proceeds

The proceeds should be managed under a dedicated account for a proper track record so the allocated and unallocated amounts are clear.

Reporting

Reporting can be divided into allocation reporting and impact reporting.

For allocation reporting, the issuer should include a list of projects that the proceeds have been allocated. The list should include the project description and the respective amount and its social benefits.

For impact reporting, the issuer should report the qualitative and quantitative performance indicators which have been set out in the Framework. The metrics might include a number of beneficiaries from the target group.

To conclude, it is the market practice to provide the above details in a Framework document which are readily accessible to the investors. The issuers are also recommended to conduct external reviews which include consultant review, verification, certification and rating to make sure the “social” is truly social and align with international standards.

Appendix

Types of Social Bonds

- Standard Social Use of Proceeds Bond

- Social Revenue Bond

- Social Project Bond

- Social Securitized and covered Bond

Source: SBP Jun 2021

The Covid-19 bond/loan

In view of the Covid-19 pandemic, ICMA has released a Q&A about issuing Social Bonds related to Covid-19. It says “All types of issuers in the debt capital markets can issue a Social Bond related to COVID-19, as long as all the four core components of the Social Bond Principles are addressed, and that the use of proceeds of the bond go exclusively towards addressing or mitigating social issues wholly or partially emanating from the coronavirus outbreak.”

Source: Social-Bonds-Covid-QA310320.pdf (icmagroup.org)

Social Bond (SB) vs Social Impact Bond (SIB)?

SB and SIB are different by nature.

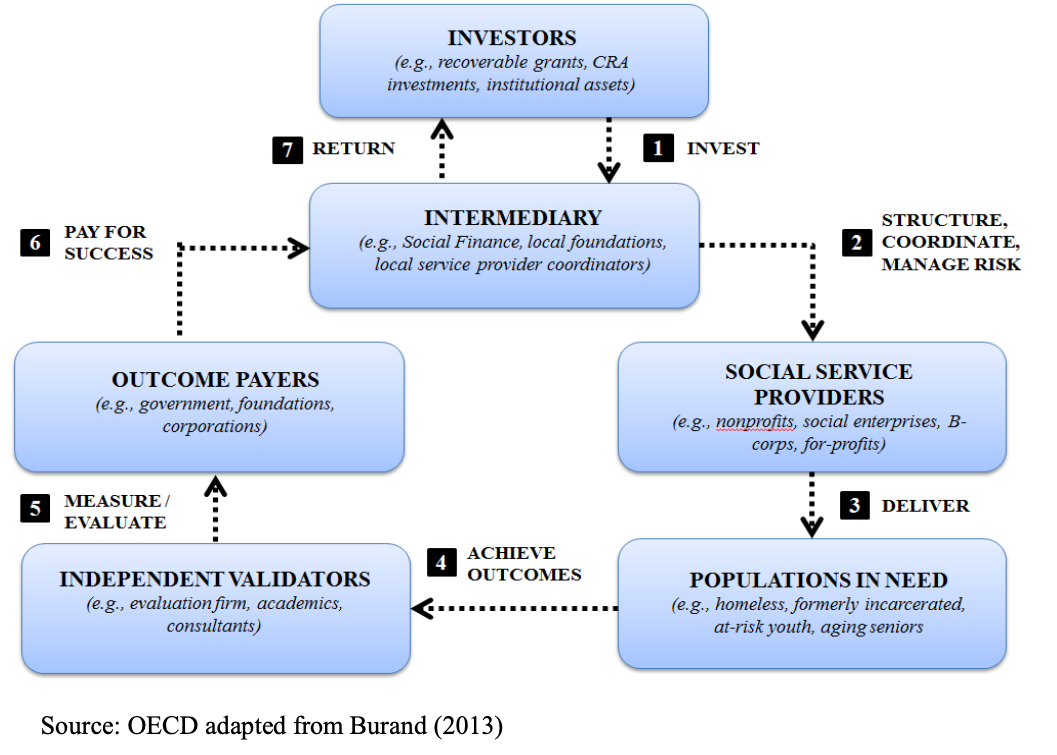

According to a report from OECD, “SIB is an innovative financing mechanism in which governments or commissioners enter into agreements with social service providers, such as social enterprises or non-profit organisations, and investors to pay for the delivery of pre-defined social outcomes.” SIB is also named as Pay-for-Success (PFS) or Pay-for-Benefits (PFB). It is hoped that this financing model could revolutionize the social service sectors.

SIB has much longer history than SB. Social Finance UK had launched its first ever SIB back in 2010.

Using public-private partnership (PPP), there are multiple stakeholders being involved in the process:

Source: Understanding SIB by OECD UnderstandingSIBsLux-WorkingPaper.pdf (oecd.org)

Other articles which brought readers to look into the pros and cons of SIB: The Downside of Social Impact Bonds (ssir.org); Measuring the success of impact bonds (brookings.edu); Paying for success: An appraisal of social impact bonds | Global Economics and Management Review (elsevier.es).

Other useful resources

- Social Bond Principles Social Bond Principles (SBP) » ICMA — International Capital Market Association (icmagroup.org)

- Social Loan Principles Social Loan Principles (SLP) — LSTA

- Impact Reporting Metrics and Databases Impact Reporting Metrics and Databases | ICMA » ICMA — International Capital Market Association (icmagroup.org)

- EU Social Taxonomy Draft Call for feedback on the draft reports by the Platform on Sustainable Finance on a social taxonomy and on an extended taxonomy to support economic transition | European Commission (europa.eu)

Comments